BRC TAMS Universe Update January 2015

1. Background

The TAM Universe is updated at regular intervals to correspond with the latest household and population figures of the All Media and Products Survey (AMPS). The next update is scheduled for the 2nd of February 2015, taking the TAMS universes from AMPS 2013A to AMPS 2014A, under the management of the Broadcast Research Council (BRC).

The last TAM Universe update occurred on the 3rd March 2014 and included demographic updates from the 2011 South African National Census.

2. Review of population changes for the 2014A Universe

The TAM Household Universe (defined as the Meter Universe in AMPS) increases by 1.5% (192 735 households), and the Individual Universe grows by 0.86% (371 019 individuals), due to a slightly lower average individuals (aged 4+) per household in the 2014A Universe.

Urban populations continue to escalate as rural populations decline. The biggest growth in TV ownership has occurred in Metro areas, with a growth of 1.49%, while the rural population has decreased by 1.06% (-149 497 individuals).

It should be noted that despite a shrinking rural population, LSM 1 – 4 has increased by 671 933 individuals. Increases in the lowest LSM groups are indicative of a general regression of household LSMs due to the slow recovery of the global economy. South Africa’s GDP declined by 0.6% in the early months of 2014. Also contributing to the downward trend of the ownership of durables (LSM) were events such as the ongoing platinum miners strikes which occurred in the first half of 2014, where less money would was available in the South African economy.

When reviewing language groups, the most notable change is the growth in the Afrikaans/Both group by 285 348 individuals (4.87%). Sotho individuals grew by 163 287 individuals (1.18%), while Nguni speakers declined slightly by -82 873 individuals (0.43%). English/Other TV viewers remained stable.

Individuals who have access to DSTV grew by almost 2 Million individuals (13.73%), this growth is being driven primarily by the uptake of the DSTV Compact Bouquet and a range of lower priced offerings. Owners of PVR decoders increased by almost 20% (550 939 individuals).

The Non Pay Universe declined by 1.5 Million individuals. Pay TV service provider, Star Sat’s penetration also declined.

Overall the Children’s Universe increased by 176 353 (1.7%) children. While children aged 4-6 years and 11-14 years have both declined slightly, the 7 – 10 year olds have increased by 7.82% (274 605 children). All standard adult age categories have increased except for the 35 to 49 age group, which declined by 36 767 individuals (-0.45%). The biggest actual and percentage increase occurred in the 65 + years age category, with 102 664 individuals (3.98%).

Refer to Appendix A for comparisons of the 2014A Universe against the 2013A Universe.

3). Impact on Viewing

- Methodology

Test data based on the new 2014A Universe was compared to the live ratings for the current TAM Universe (2013A), and covered two weeks, 13th October to 26th October. Full Day (2h00 to 26h00) and Prime Time (17h00 to 22h59) were examined.

Comparisons were made for Total Individuals as well as pre-selected, commonly traded, target markets:

- Adults 15+

- Children 4 – 14 years

- Adults LSM 1 – 4, Adults LSM 5 – 7, Adults LSM 8 – 10

- Adults Nguni, Adults Sotho, Adults English/Other, Adults Afrikaans/Both

- Weighting Efficiency

When the 2014A Universe is applied to the TAM data, weighting efficiencies improve from an average of 68% to an average of 74%.

Weighting efficiency is a statistical measure that reflects how closely the sample proportions match the Universe proportions as well as the complexity of the weighting system. A high weighting efficiency is indicative of good panel health and good sample representivity.

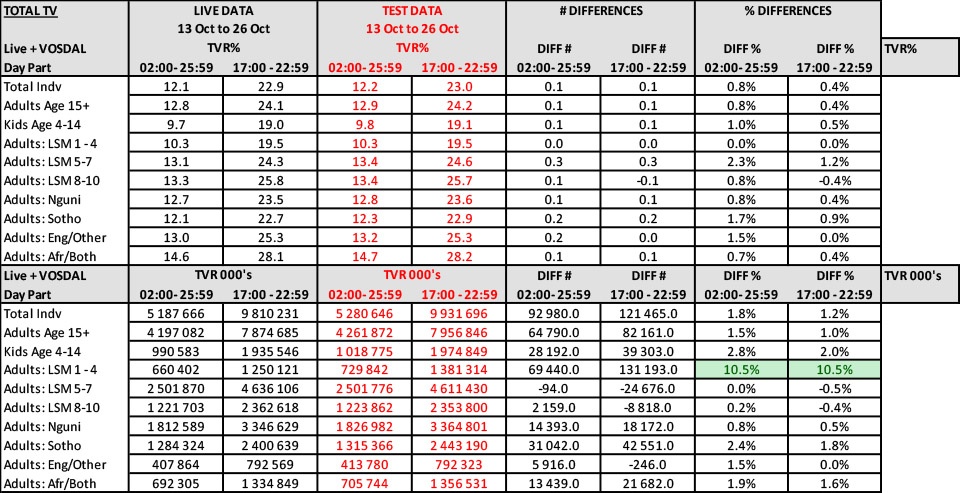

- Total TV

Total TV Ratings for Total Individuals are stable at 12.1% in the live data and 12.2% in the test data for Full Day and from 22.9% to 23% for Prime Time, once the 2014A Universe is applied. With the marginal increase in the universe size, the stable viewing in TVR % translates into an increase of almost 93 000 additional average viewers (TVRs in 000s) for the full TV day and 121 465 average viewers for Prime Time.

Due to the decline in the LSM 5 – 7 and LSM 8 – 10 Universes, both these target markets showed declines in actual TV Rating in 000s. The LSM 5 – 7 group showed a decline of 24 676 individuals during Prime Time, while the LSM 8 – 10 group showed a decline of 8 818 viewers. However, while LSM 8 – 10 exhibited a decline in TVRs % ratings for Prime Time, LSM 5 -7 showed slight increases in percentage ratings.

It should be noted that on a Total TV level, the changes discussed above are more reflective of the data remaining stable, than signalling any substantial changes.

Table 1: TOTAL TV

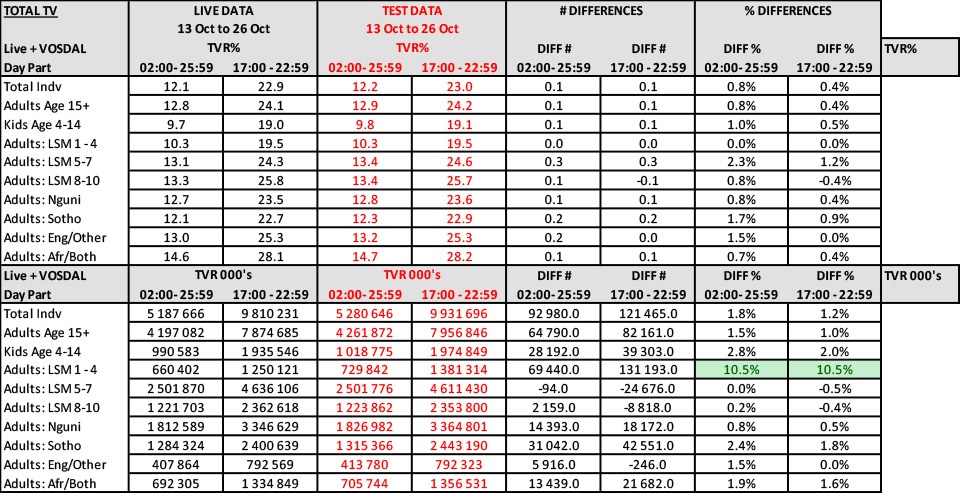

- SABC 1 and SABC 2 Viewing

Total Individuals for SABC 1 declines in percentage ratings (0.1 rating for Full Day and 0.2 ratings for Prime Time) as well as actual audience count (-25 141 for Full Day; – 51 200 for Prime Time).

However, both SABC 1 and SABC 2 are the benefactors of the increase in the LSM 1 – 4 Universe, as seen by the growth in actual audience numbers for this target market (SABC 1 Prime Time grows by 65 732; SABC 2 Prime Time by 21 894). It should be noted though, that percentage ratings for this target group remains stable, rather than showing growth.

The decrease in total audience for SABC 1 may be attributed to the decline seen in the LSM 5-7 and LSM 8 – 10 target markets, occurring across all the free to air channels. This is driven by two factors: Firstly, the Universe figures for these two target groups have declined; secondly, the growth in DSTV uptake comes primarily from LSM 5- 7, who are also mostly Nguni or Sotho speakers. Percentage ratings also decline for the LSM 5 – 7 target markets, but remains stable for LSM 8 – 10.

There is growth for the Afrikaans/Both language groups for all channels, which reflects the growth of the Universe of this target market.

Table 2: SABC 1

Table 3: SABC 2

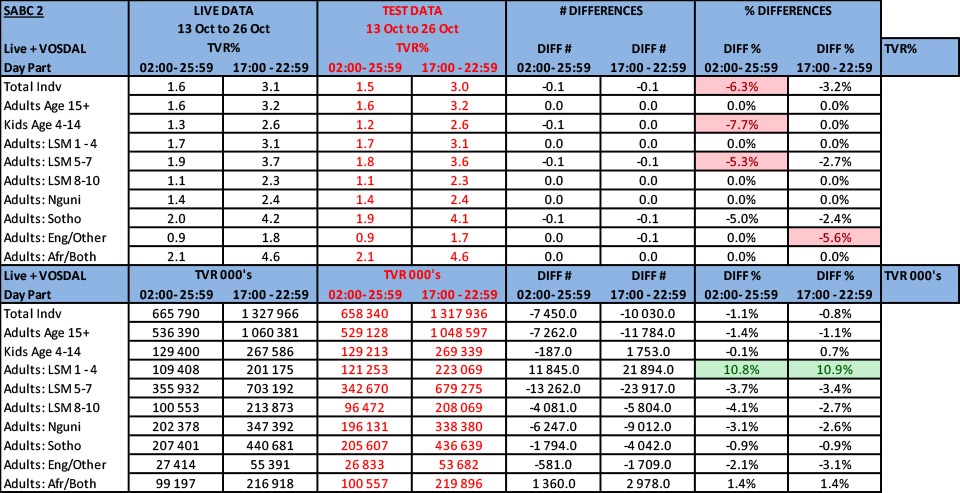

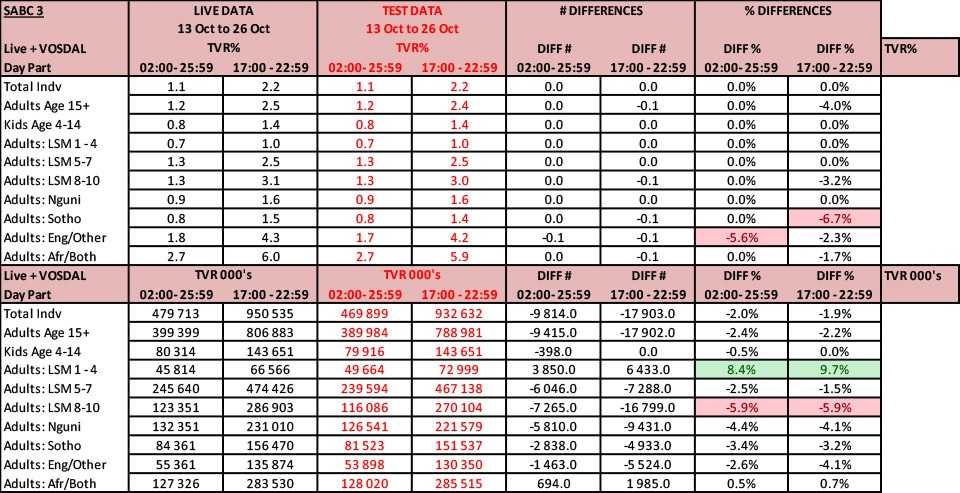

- SABC 3 Viewing

Overall, percentage ratings for SABC 3 remain stable, with decreases in the Sotho and English/Other language groups. Declines in audience numbers are small, again indicating stability, rather than negative growth.

Table 4: SABC 3

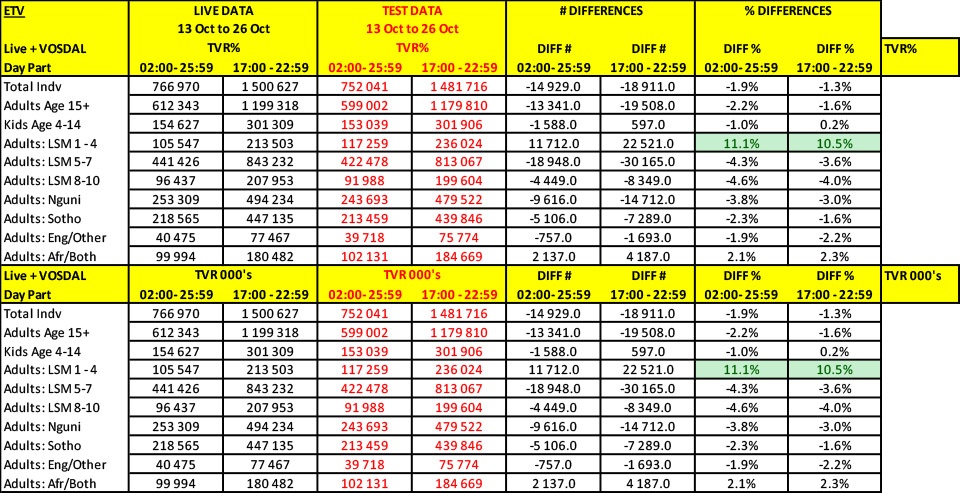

- ETV Viewing

The ETV percentage ratings and audience count declines for Total Individuals by 18 911 for Prime Time, which is a 1.3% negative growth. However, as is the case with the SABC channels, the LSM 1 – 4 groups increase in line with the growth of this Universe’s numbers. The Afrikaans/Both audiences also show growth for ETV.

These changes are not substantial.

Table 5: Table ETV

- DSTV Viewing

Due to the 13.7% growth in the uptake of DSTV subscriptions, all target markets increase for Total DSTV channels. The most notable growth in average audience count (TVR 000’s) is for the LSM 5 – 7 target market, with increases of 71 646 for Full Day and 106 827 for Prime Time. Although LSM 1 – 4 also shows growth, the audience size of this target market is small (ranging between 6 713 and 14 639 individuals) for DSTV compared to the SABC channels, where it has more dominance. It must also be noted that performance is not consistent by DStv channel. Depending on which bouquet a channel can be accessed on, the increase in viewership performance differs. Compact and the lower end bouquets are growing faster than Premium.

Table 6: DSTV Total

- Conclusion

- Weighting Efficiencies improve when the new Universe is implemented (from 68% to 74%, reflecting good panel health.

- General regression of LSM’s results in declines in the LSM 5 – 7 and LSM 8 – 10 group and LSM 1 – 4 increases. These population changes are reflected in the viewing.

- DSTV gains due to increased penetration and increased time spent viewing (ATV). Particularly for target markets, LSM 5 – 7, and the Nguni and Sotho language groups. This may be attributed to increased subscription to the Compact Bouquet and less expensive offerings.

Appendix A 2014a and 2013a comparisons (individual and household)

Individual comparison

| TOTAL |

CURRENT |

NEW |

Growth |

||

| INDIVIDUALS |

UNIVERSE |

UNIVERSE |

# |

% |

|

| AGES 4+ |

AMPS 2013A |

AMPS 2014A |

|||

|

42 900 434 |

43 271 453 |

371 020 |

|||

| Total Males | POP |

20 917 095 |

21 001 266 |

84 171 |

0.40% |

| Total Females | POP |

21 983 339 |

22 270 187 |

286 848 |

1.30% |

|

42 900 434 |

43 271 453 |

371 019 |

0.86% |

||

| Western Cape | POP |

5 171 677 |

5 358 634 |

186 957 |

3.62% |

| Northern Cape | POP |

948 920 |

989 314 |

40 394 |

4.26% |

| Free State | POP |

2 374 211 |

2 282 641 |

-91 571 |

-3.86% |

| Eastern Cape | POP |

4 721 617 |

4 596 605 |

-125 012 |

-2.65% |

| Kwazulu-Natal | POP |

8 019 866 |

7 880 135 |

-139 731 |

-1.74% |

| Mpumalanga | POP |

3 351 713 |

3 431 714 |

80 002 |

2.39% |

| Limpopo | POP |

4 217 938 |

4 359 727 |

141 790 |

3.36% |

| Gauteng | POP |

11 258 620 |

11 394 018 |

135 398 |

1.20% |

| North-West | POP |

2 835 875 |

2 978 666 |

142 792 |

5.04% |

|

42 900 434 |

43 271 453 |

371 019 |

0.86% |

||

| Afrikaans/Both | POP |

5 862 358 |

6 147 705 |

285 348 |

4.87% |

| English/Other | POP |

3 758 919 |

3 764 178 |

5 259 |

0.14% |

| Nguni | POP |

19 419 082 |

19 336 209 |

-82 873 |

-0.43% |

| Sotho | POP |

13 860 076 |

14 023 362 |

163 287 |

1.18% |

|

42 900 434 |

43 271 453 |

371 020 |

0.86% |

||

| LSM 1 -4 | POP |

6 424 494 |

7 096 426 |

671 933 |

10.46% |

| LSM 5 | POP |

8 160 581 |

7 545 978 |

-614 603 |

-7.53% |

| LSM 6 | POP |

11 208 580 |

11 268 949 |

60 370 |

0.54% |

| LSM 7 | POP |

5 704 423 |

5 973 602 |

269 179 |

4.72% |

| LSM 8 | POP |

3 712 693 |

4 140 441 |

427 749 |

11.52% |

| LSM 9 | POP |

4 629 046 |

4 453 012 |

-176 034 |

-3.80% |

| LSM 10 | POP |

3 060 619 |

2 793 046 |

-267 574 |

-8.74% |

|

42 900 434 |

43 271 453 |

371 019 |

0.86% |

||

| LSM 1 – 4 | POP |

6 424 494 |

7 096 426 |

671 933 |

10.46% |

| LSM 5 – 7 | POP |

25 073 583 |

24 788 529 |

-285 055 |

-1.14% |

| LSM 8 – 10 | POP |

11 402 357 |

11 386 498 |

-15 859 |

-0.14% |

|

42 900 434 |

43 271 453 |

371 019 |

0.86% |

||

| Age 04 – 06 | POP |

3 311 373 |

3 294 311 |

-17 062 |

-0.52% |

| Age 07 – 10 | POP |

3 509 583 |

3 784 188 |

274 605 |

7.82% |

| Age 11 – 14 | POP |

3 356 281 |

3 275 090 |

-81 191 |

-2.42% |

| Age 15 – 24 | POP |

8 243 681 |

8 297 724 |

54 043 |

0.66% |

| Age 25 – 34 | POP |

8 149 340 |

8 184 426 |

35 086 |

0.43% |

| Age 35 – 49 | POP |

8 128 385 |

8 091 618 |

-36 767 |

-0.45% |

| Age 50-64 | POP |

5 623 721 |

5 663 362 |

39 641 |

0.70% |

| Age 65 + | POP |

2 578 070 |

2 680 734 |

102 664 |

3.98% |

|

42 900 434 |

43 271 453 |

371 020 |

0.86% |

||

| Children | POP |

10 177 237 |

10 353 589 |

176 353 |

1.73% |

| Adults 15+ | POP |

32 723 197 |

32 917 864 |

194 667 |

0.59% |

|

42 900 434 |

43 271 453 |

371 020 |

0.86% |

||

| Metro | POP |

17 975 234 |

18 243 609 |

268 375 |

1.49% |

| C/LT | POP |

5 683 857 |

5 701 687 |

17 831 |

0.31% |

| ST/V | POP |

5 084 017 |

5 318 327 |

234 310 |

4.61% |

| Rural | POP |

14 157 327 |

14 007 831 |

-149 497 |

-1.06% |

|

42 900 434 |

43 271 453 |

371 019 |

0.86% |

||

| Star Sat No | POP |

42 272 063 |

42 892 920 |

620 857 |

1.47% |

| Star Sat Yes | POP |

628 371 |

378 533 |

-249 838 |

-39.76% |

|

42 900 434 |

43 271 453 |

371 020 |

0.86% |

||

| DSTV SUBSCRIBER FIGURES | |||||

| DSTV | POP |

13 626 834 |

15 497 862 |

1 871 027 |

13.73% |

| NON DSTV | POP |

29 273 600 |

27 773 591 |

-1 500 009 |

-5.12% |

|

42 900 434 |

43 271 453 |

371 019 |

0.86% |

||

| DSTV SUBSCRIBER FIGURES | |||||

| PVR YES Ind new | POP |

2 770 512 |

3 321 450 |

550 939 |

19.89% |

| PVR NO Ind new | POP |

40 129 922 |

39 950 003 |

-179 919 |

-0.45% |

|

42 900 434 |

43 271 453 |

371 020 |

0.86% |

||

Household comparison

| TOTAL |

CURRENT |

NEW |

Growth |

||

| HOUSEHOLDS |

UNIVERSE |

UNIVERSE |

# |

% |

|

|

AMPS 2013A |

AMPS 2014A |

||||

|

12 837 052 |

13 029 788 |

||||

| Metro |

HH |

5 719 938 |

5796292 |

76 354 |

1.3% |

| C/LT |

HH |

1 768 526 |

1742375 |

-26 151 |

-1.5% |

| ST/V |

HH |

1 537 305 |

1577272 |

39 967 |

2.6% |

| Rural |

HH |

3 811 284 |

3913849 |

102 565 |

2.7% |

| TOT |

HH |

12 837 053 |

13 029 788 |

192 735 |

1.5% |

| Western Cape |

HH |

1 471 438 |

1549889 |

78 451 |

5.3% |

| Northern Cape |

HH |

293 935 |

263279 |

-30 656 |

-10.4% |

| Free State |

HH |

808 966 |

745126 |

-63 840 |

-7.9% |

| Eastern Cape |

HH |

1 259 248 |

1277398 |

18 150 |

1.4% |

| Kwazulu-Natal |

HH |

2 137 192 |

2131101 |

-6 091 |

-0.3% |

| Mpumalanga |

HH |

996 806 |

1011049 |

14 243 |

1.4% |

| Limpopo |

HH |

1 287 055 |

1374673 |

87 618 |

6.8% |

| Gauteng |

HH |

3 745 050 |

3760829 |

15 779 |

0.4% |

| North-West |

HH |

837 361 |

916445 |

79 084 |

9.4% |

| TOT |

HH |

12 837 051 |

13 029 789 |

192 738 |

1.5% |

| Afrikaans/Both |

HH |

1 847 783 |

1882424 |

34 641 |

1.9% |

| English/Other |

HH |

1 293 285 |

1297805 |

4 520 |

0.3% |

| Nguni |

HH |

5 429 381 |

5435922 |

6 541 |

0.1% |

| Sotho |

HH |

4 266 602 |

4413638 |

147 036 |

3.4% |

| TOT |

HH |

12 837 051 |

13 029 789 |

192 738 |

1.5% |

| StarSat – No |

HH |

12 675 386 |

12925467 |

250 081 |

2.0% |

| StarSat – Yes |

HH |

161 666 |

104322 |

-57 344 |

-35.5% |

| TOT |

HH |

12 837 052 |

13 029 789 |

192 737 |

1.5% |

| LSM 1 -4 |

HH |

1 986 139 |

2146841 |

160 702 |

8.1% |

| LSM 5 |

HH |

2 366 199 |

2310444 |

-55 755 |

-2.4% |

| LSM 6 |

HH |

3 302 789 |

3284251 |

-18 538 |

-0.6% |

| LSM 7 |

HH |

1 700 795 |

1729290 |

28 495 |

1.7% |

| LSM 8 |

HH |

1 131 735 |

1286072 |

154 337 |

13.6% |

| LSM 9 |

HH |

1 412 045 |

1420279 |

8 234 |

0.6% |

| LSM 10 |

HH |

937 349 |

852612 |

-84 737 |

-9.0% |

| TOT |

HH |

12 837 051 |

13 029 789 |

192 738 |

1.5% |

| HH Size 1 to 3 members |

HH |

7 195 549 |

7289161 |

93 612 |

1.3% |

| HH Size 4 to 5 members |

HH |

3 782 137 |

3813765 |

31 628 |

0.8% |

| HH Size 6+ members |

HH |

1 859 365 |

1926862 |

67 497 |

3.6% |

| TOT |

HH |

12 837 051 |

13029788 |

192 737 |

1.5% |

| DSTV SUBSCRIBER FIGURES | |||||

| DSTV |

3 928 093 |

4 436 879 |

508 786 |

13.0% |

|

| NON DSTV |

8 908 958 |

8 592 910 |

-316 048 |

-3.5% |

|

|

12 837 051 |

13 029 789 |

192 738 |

1.5% |

||

| DSTV SUBSCRIBER FIGURES | |||||

| PVR |

HH |

857 240 |

1 018 660 |

161 420 |

18.8% |

| NON PVR |

HH |

11 979 811 |

12 011 129 |

31 318 |

0.3% |

|

12 837 051 |

13 029 789 |

192 738 |

1.5% |

||